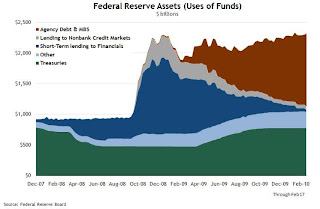

We've talked a lot about how the Fed's purchase of Mortgage Backed Securities has kept rates low. The chart below shows the Fed's balance sheet and how it has changes with the aggressive purchase of MBSs.

In case you're having trouble see it, the MBS portion is the brown wedge in the upper right. You can see how the Fed has been buying aggressively since Feb 2009.

Here's how MBS purchases have trended:

According to the Fed's February 24, 2010 financial highlights:

- The Fed purchased a net total of $11 billion of agency-backed MBS through the week of February 17. This purchase brings its total purchases up to $1.199 trillion, and by the end of the first quarter of 2010 the Fed will have purchased $1.25 trillion (thus, it is 96% complete).

Mortgage rates spiked in June 2009 even as the Fed came off some of its heaviest buying of MBS. But as the Fed continued to absorb mortgage backed securities, rates fell through the second half of the year. Connected? Maybe.

As the Fed ends its purchase of MBS's over the next couple of months, it will be interesting to see its impact on mortgage rates.

Add your Comment

or use your BestCashCow account